Round‑up

- TSMC soothes investors with a 54 % profit pop and steady cap‑ex, even as Trump‑era tariff clouds gather.1

- Intel quietly tells Chinese buyers that any AI chip over 1.4 TB/s bandwidth now needs a U.S. export license—Gaudi accelerators included.2

- ASML’s Q1 orders miss by €1 bn; CEO warns he “can’t yet quantify” U.S. tariff shock on EUV demand.3

Other developments

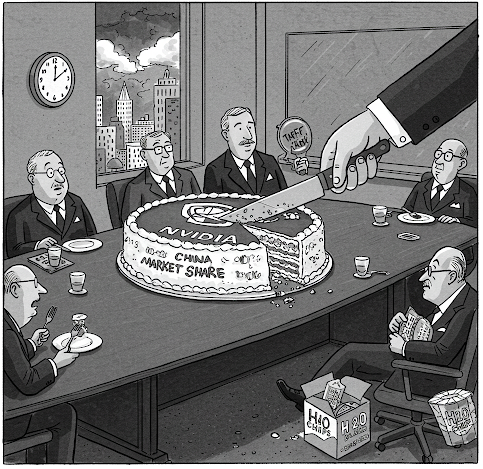

- Nvidia’s Jensen Huang lands in Beijing, calling China “very important” despite H20 ban.4

- Chip stocks shed $250 bn in a single session as Nvidia flags a $5.5 bn charge from curbs.5

- Reuters reveals Nvidia kept key Chinese customers in the dark about the new rules.6

- Ars Technica tallies a potential $1 billion industry cost from looming tariff hikes.7

Did You Know?

TSMC added another $100 billion to its U.S. build‑out just last month, taking its Arizona commitment past the $165 bn mark and making it the largest overseas fab spend in history.8

In‑depth

1 Government & Corporate Policy

-

Fresh license wall for AI silicon

- Intel confirms Financial‑Times report that advanced Gaudi parts now fall under the new 1.4 TB/s export threshold.2

- Rule mirrors the October ’24 GPU clamp‑down and ensnares most U.S. AI accelerators.

-

Nvidia’s Beijing charm offensive

- CEO Jensen Huang meets China’s trade‑promotion agency and reiterates commitment to the market amid H20 embargo.4

- Visit is read domestically as a signal that compliant GPUs might still flow.

-

Tariff whiplash hits markets

- Wall Street slides 3 % after Powell flags growth risks and Nvidia warns on charges linked to the new curbs.5

- Semiconductor index (SOX) drops 4.1 % in the session.

-

ASML export‑risk rhetoric

- Dutch tool giant says it cannot yet model tariff fallout, underscoring policy uncertainty around equipment flows to China.3

2 Economics, Finance & Business Outlook

-

TSMC lifts the gloom

- Q1 profit +54 % Y/Y; management sticks to full‑year spend plan and cites “AI packaging strength” for resilience.1

- Shares in Frankfurt jump 5.5 % on the print.

-

Chip‑stock wipe‑out

- Nvidia’s $5.5 bn charge tied to H20 licenses sparks sector‑wide rout, erasing $250 bn in value in two days.5

- Brokers flag Lam Research and Applied Materials as most exposed.

-

ASML order slump

- Bookings of €3.94 bn vs. €4.8 bn est.; company blames tariff‑driven hesitancy among leading‑edge fabs.3

- Shares fall 5 % pre‑market before recovering on long‑term growth commentary.

-

Investor flight from Taiwan equities

- Foreigners have sold $8.66 bn of TSMC stock YTD amid tariff angst, Goldman notes.1

3 Technology & R&D

-

EUV uncertainty vs. High‑NA roadmap

- ASML says demand for mature‑node DUV tools is roaring back even as tariff drama clouds high‑end shipments.3

- Firm reiterates first High‑NA EUV tools ship to Intel and TSMC only.

-

Spec‑based export controls tighten design limits

- New 1.4 TB/s bandwidth cap forces chip architects to split dies or throttle memory links, complicating roadmaps.2

- ODMs already examining Singapore assembly routes to stay compliant.

-

Nvidia warning ripple effect

- Some Chinese hyperscalers learned of indefinite license rule only after Nvidia disclosed it publicly, Reuters finds.6

- Procurement teams scramble to re‑spec mid‑range clusters around older A800 parts.

-

AI packaging keeps fabs busy

- TSMC credits high‑density wafer‑on‑wafer CoWoS output for offsetting smartphone weakness and sustaining N3P utilisation.1

Footnotes

-

Reuters – “TSMC forecast lifts gloomy mood in chip stocks, tariff worries linger,” Apr 17 2025. ↩︎ ↩︎ ↩︎ ↩︎ ↩︎

-

Reuters – “Intel will need license to export AI chips to Chinese clients, FT reports,” Apr 16 2025. ↩︎ ↩︎ ↩︎

-

Bloomberg – “ASML CEO Warns US Tariffs Are Creating Chip Sector Uncertainty,” Apr 16 2025. ↩︎ ↩︎ ↩︎ ↩︎

-

Reuters – “Nvidia CEO stresses importance of China market in Beijing visit,” Apr 17 2025. ↩︎ ↩︎

-

Reuters – “Indexes drop as Fed’s Powell says growth appears to be slowing; Nvidia tumbles,” Apr 16 2025. ↩︎ ↩︎ ↩︎

-

Reuters – “Nvidia kept some China customers in the dark about new US chip clampdown,” Apr 16 2025. ↩︎ ↩︎

-

Ars Technica – “Trump’s tariffs could cost semiconductor industry $1 billion, industry fears,” Apr 16 2025. ↩︎

-

Reuters – same as 1, line 15 (extra $100 bn U.S. investment). ↩︎